Earnings growth rate formula

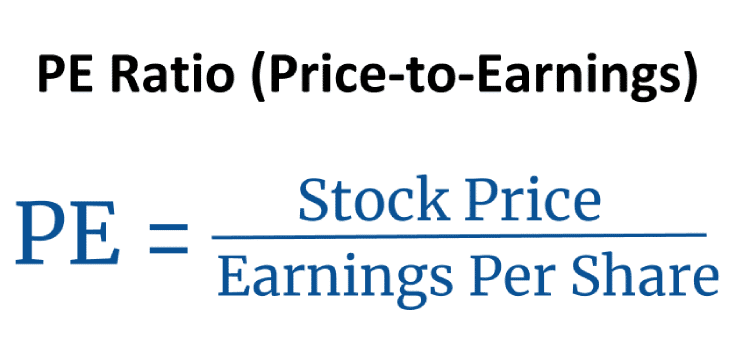

EPS Growth Formula. The basic PE formula takes the current stock price and EPS to find the current PE.

Price Earnings Ratio Formula Examples And Guide To P E Ratio

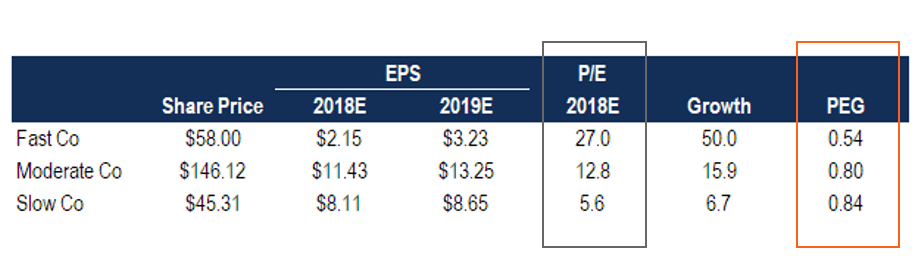

A PEG ratio is both grounded in objective information and is forward-looking a factor.

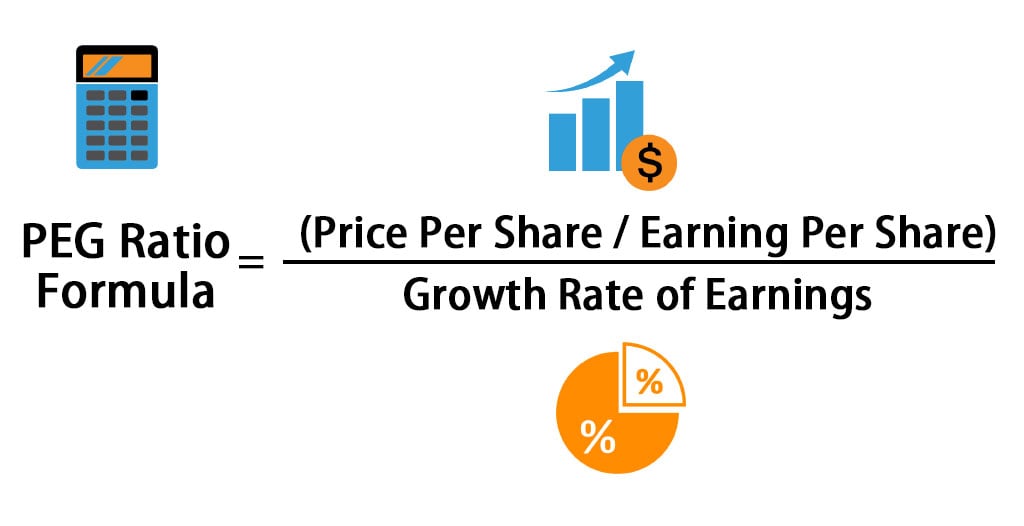

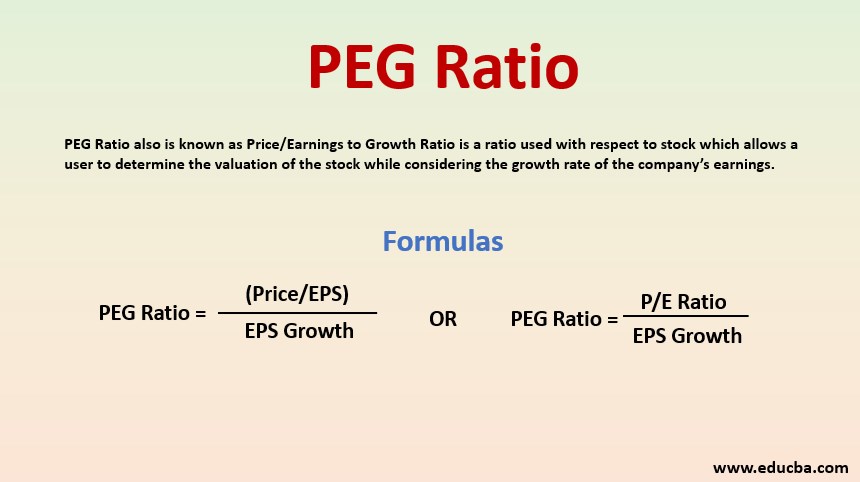

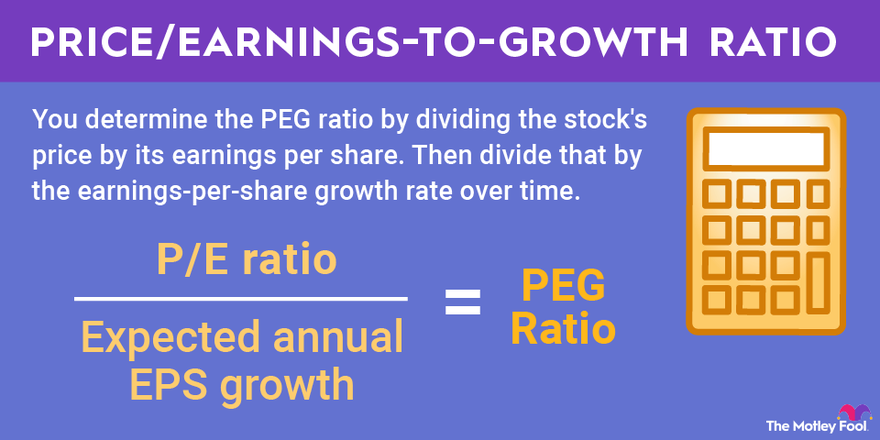

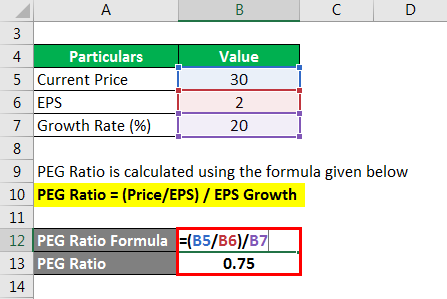

. The PEG ratio is a companys PriceEarnings ratio divided by its earnings growth rate over a period of time typically the next 1-3 years. EPS Growth EPS this year EPS last year 1. Earnings growth rate is a key value that is needed when the Discounted cash flow model or the Gordons model is used for stock valuation.

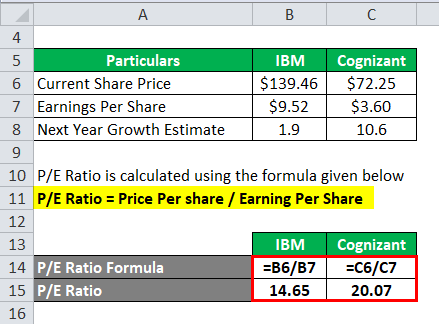

Using the PEG ratio formula can be. PE Ratio 60x. The main difference is that the return on equity ROE is used instead of the return on assets ROA.

G Sustainable Growth Rate. We do this by dividing the latest earnings per share number. A variation of the price-to-earnings ratio where a stocks value is further evaluated by its projected earnings growth.

PEG Ratio 60x PE Ratio. Assuming the companys expected EPS growth rate is 20 the ratio can be calculated as. If you want the past growth rate youll need that specific periods ROIC and reinvestment rate.

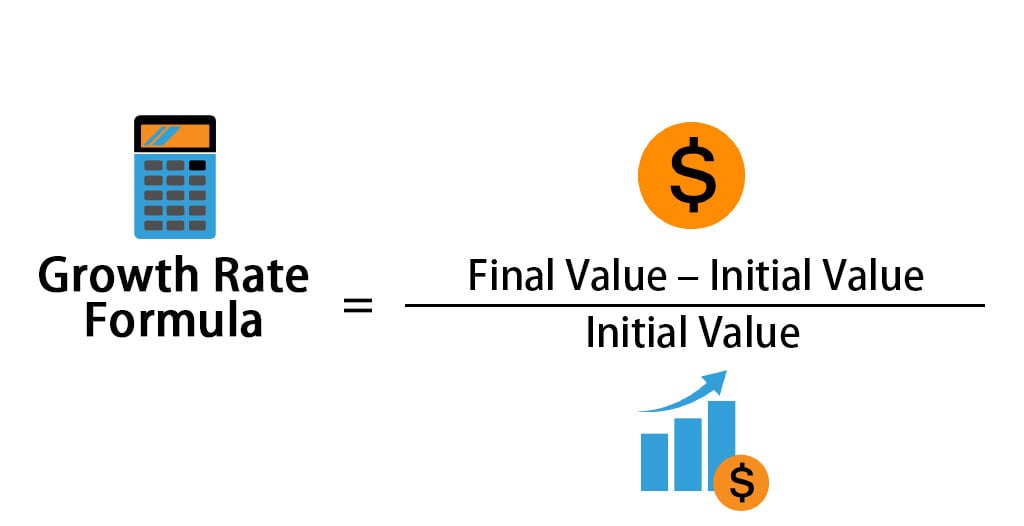

To determine an annual portion growth rate more than one year subtract the starting value through the final value then divide by simply the starting value. When you need to calculate the compounded EPS growth rate of the company over a period of years. To calculate Procter Gambles EPS growth rate over these nine years we must first calculate the growth multiple.

The ratios are already summarizing over their respective periods. The formula for the sustainable growth rate is similar to the formula for IGR. Assuming theres no other.

PE Ratio Formula Explanation. A business reports 1 million of net income at the end of the year and then reports 13 million at the end of the following year. PE Ratio 30 Share Price 500 Diluted EPS.

Priceearnings-to-growth Market price of stocks per shareEPS Earnings per share growth rate. Where P the present value k discount rate D. Contents show earnings.

EPS is found by taking. PriceEarnings to Growth and Dividend Yield - PEGY Ratio. Example of Earnings Growth.

Peg Ratio Vs Price To Earnings P E Ratio Youtube

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Earnings Per Share Eps Growth Calculator

Growth Rate Formula Calculator Examples With Excel Template

Price Earnings To Growth Peg Ratio Financial Edge

Peg Ratio Price Earnings Growth Ratio What It Really Means

Peg Ratio Example Explanation With Excel Template

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Earnings Per Share Formula Eps Calculator With Examples

What Is The Peg Ratio

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Peg Ratio Example Explanation With Excel Template

Peg Ratio Definition Equation Calculation